Understanding Value-Added Tax Rate in Ireland: Structure, Implications, and Key Conclusions

Value Added Tax forms an integral feature of the Irish system of taxation, impacting strongly on the course of businesses and the consuming public. Being a tax on consumption levied on the value addition of a good or service at each stage of supply, it has always formed an integral part of the revenue generation for the Irish government. The following article shall discuss the VAT rate in Ireland, touching on the structure, present rates, exemptions, and implications for various stakeholders involved.

What is VAT?

Value Added Tax, commonly referred to as VAT, refers to a tax assessed on the value added to goods or services at each stage of production or distribution. It ultimately falls to the end consumer and is, therefore, an indirect tax. The business charges the customer for VAT in the sale of goods or services and collects it on behalf of the government. The collected VAT is paid over to the Revenue Commissioner body responsible for the administration of tax in Ireland.

VAT structure in Ireland

The value-added tax system of Ireland is based upon the VAT directive of the European Union, which requires all member states to follow some rules while offering flexibility regarding the setting of rates. The Irish Value Added Tax applies a multiple-rate structure. In fact, there are three key rates of VAT:

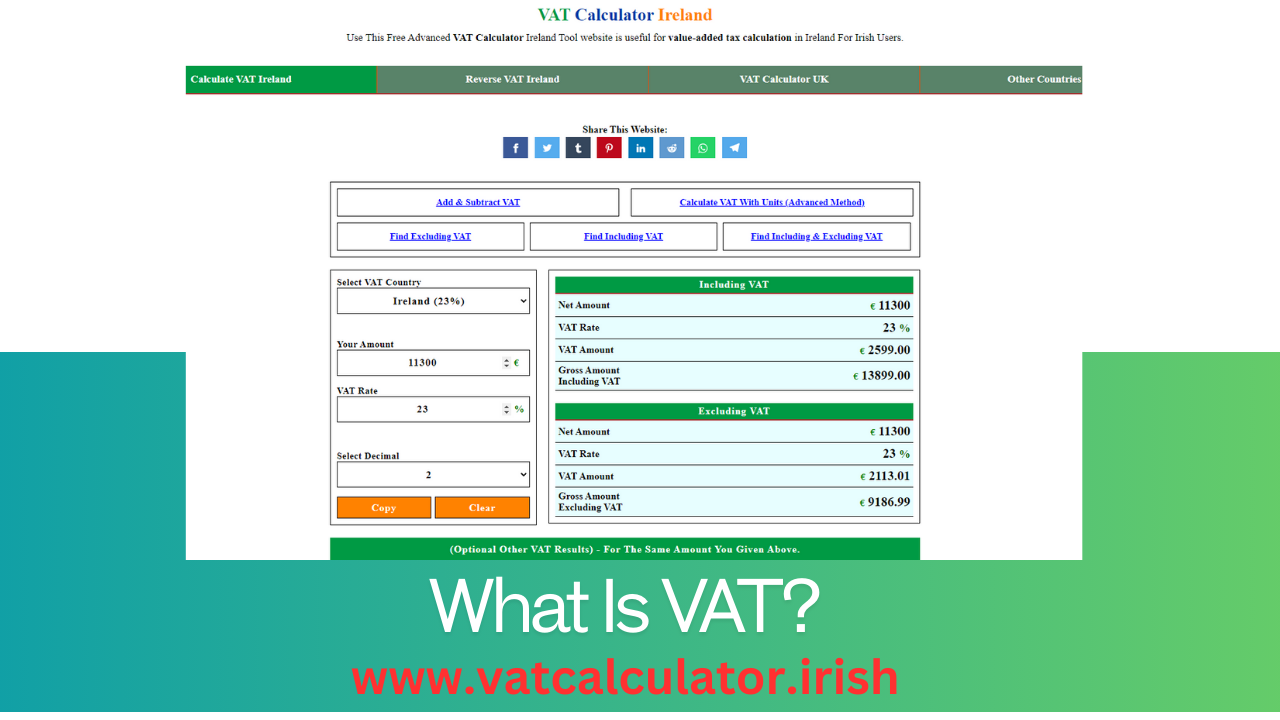

- Standard Rate: The standard VAT rate stands at 23% in Ireland. It applies to most goods and services sold in the country.

- Reduced Rates: There are two reduced rates of VAT:

- 13.5%: This is charged on goods and services, with examples falling under specific construction services, hotels, and catering.

- 9%: This applies to the hospitality sector, with the main drivers of restaurant services and hotel accommodation. This rate has been in place for a short period to help the sector during the economic crisis.

- Zero Rate: Some basic commodities like food, children's clothes, and books enjoy a 0% VAT rate. In this case, the burden on consumers is eased in a more flexible way.

VAT Registration

Businesses should be registered for VAT if their turnover of taxable goods and services exceeds a certain limit, currently €75,000 in respect of goods and €37,500 in respect of services. Businesses that become so registered must charge VAT on their sales and submit VAT returns on an ongoing basis to the Revenue Commissioners. There is a facility for small businesses to avail of a VAT Accounting Scheme for Small Businesses, which relieves them of accounting for VAT on an accruals basis and, instead, allows them to account for it on a cash receipts basis, thereby simplifying problems with liquidity.

Implication of VAT to the Businesses

Compliance and Reporting

For businesses operating in Ireland, there is a need to comply with VAT regulations. In this respect, there is a need for business enterprises to keep proper records for every transaction whether sales or purchases which may have implications for proper reporting of VAT. Essentially, it requires the issuance of VAT invoices, which are mandated to have specific details like the rate of VAT charged as well as the VAT registration number.

Failure to do so may attract some penalties and interest charges, and even audit possibilities by the Revenue Commissioners. Hence, understanding the ropes of VAT becomes a prerequisite for any entrepreneur to enable him to understand the many nuances of tax compliance.

Pricing Strategies

The pricing policy is directly influenced by the VAT rate. Business enterprises must fix the selling price keeping in mind that the price the final consumer will pay will be inclusive of the relevant rate of VAT. Thus, for example, a product priced at €100 will be sold for €123 inclusive of VAT at the standard rate. Additionally, business has to strike a balance between competitive pricing and the obligation of retaining conformity with VAT legislation.

Cash Flow Management

Value-added tax can have major implications for cash flow management. VAT payable on businesses' purchases adds pressure to cash flow if they do not have it collected yet from customers. To address these challenges, cash flow management in the business environment could be supported by a series of strategies, including but not limited to maintaining reserves to cover VAT liabilities or utilizing the cash-based accounting method when applicable.

VAT Exemptions and Reliefs

While VAT is of immense contribution to the country's treasury, some goods and services are exempted from paying VAT or at a reduced rate in order to alleviate the burden on the consumers. Some exemptions in this regard are as under:

Exempt Goods and Services

- Healthcare Services: Most health care provided by medical professionals enrolled in the State Register is free from paying any VAT. The services include visits to the doctor, medical facilities extended by hospitals, and prescribed medicinal consumables.

- Educational Services: All educational services provided by accredited institutions and establishments are exempt from payment of VAT. This covers primary, secondary, and higher education.

- Financial Services: Services of banking and insurance are among the financial services that fall under zero-rating for the purposes of VAT. The service is actually indispensable in economic activity.

Value-Added Tax Reliefs

There are specific reliefs for VAT that are available to certain sectors, including:

- Tourism: The 9% VAT for the hospitality industry has been utilized for a tourism package and to facilitate economic recovery. For hotels, restaurants, and tourist attractions, this is quite substantial relief.

- Charitable Organizations: In some respects, charities may obtain VAT relief on goods and services in order to free up more resources for charitable work.

How Consumers Are Affected by Value-Added Tax

Price Increase

Consumers pay for the VAT since businesses pass on the tax down to the customer through higher prices. If consumers can understand the implications of VAT, they will be able to make more informed choices about what to buy and how much of it. For example, essential commodities such as food and children's clothing are exempt from paying VAT and are thus relatively cheap for consumers.

Growing in Importance but Likely Least Understand: VAT Rates

Informed consumers can navigate the market better. Knowledge of the VAT rates may, for example, determine purchase decisions, especially for sectors where reduced rates have been applied. Consumers, therefore, would want to make purchases from businesses that sell goods and services at a reduced price due to the application of the VAT.

Government Revenue

Value-added tax is one of the sources of the Irish government's income for financing social services, building bridges and roads, and establishing welfare. Understanding the importance of VAT can help build civic responsibility among consumers to be in compliance with the regulations in terms of taxes.

VAT and the Irish Economy

VAT has always played an increasingly significant role in economic life. It affects Government revenue, the operation of each individual business, and consumer choice. The VAT system is supposed to be effective, fair, and adaptable to an economy in flux. Being a part of the European Union, Ireland works within a set of agreed rules, but with some latitude allowed for setting special rates that assist Ireland in pursuing its economic objectives.

Economic Recovery and VAT

The Irish government has moved VAT rates in respect of economic challenges-for example, the COVID-19 pandemic-to stimulate economic recovery. The temporary reduction of VAT rates serves to show how much concern the government has for businesses and their customers during challenging times.

Future Developments

The discussion of reforms and changes in the VAT will continue to go hand in hand with the ever-changing nature of global economic conditions. It is also possible that the Irish government may change some of these VAT rates, introduce new reliefs, or alter the existing ones against changing economic challenges or consumption behaviors. In this regard, businesses and consumers are advised to be informed about the likely changes in VAT policy from time to time.

Conclusion

Though being an important matter in Ireland, the VAT rate is one of the crucial matters to businesses and consumers, among other participants in the economy. The multi-tiered VAT rate, containing the standard, reduced, and zero rates, forms a very important source of revenue for the Irish government while making it fair by exempting the most vital items. This means that every business operating in Ireland needs to understand the minutiae of VAT in regard to compliance matters and what those mean in terms of pricing strategy.

Conclusion to VAT in Ireland

VAT is much more than a tax; it is a system indicative of the approach taken by the government to the management of the economy and the provision of public services. The VAT system will constantly undergo a metamorphosis of challenges and opportunities in the ever-changing economic circumstances. It is, therefore, very important that businesses and consumers are vigilant through awareness to sail through this dynamic environment. Understanding VAT means a healthy economic environment in Ireland, one that is sustainable and will grow with all its stakeholders.